What Is Quit Rent In Malaysia

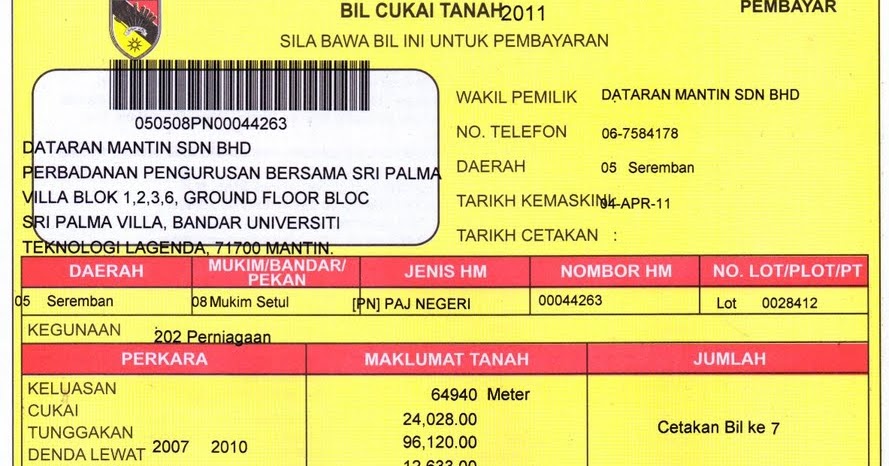

The bill is yellow in colour.

What is quit rent in malaysia. Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia. It is the replacement of a quit rent to property parcel owners with strata title. Though mandated by federal law state governments assess and collect all quit rent.

It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year. Quit rent quit rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns. This applies to landowners and is paid to the land office for both leasehold and freehold property.

Real property gains. Meanwhile assessment tax cukai taksiran is collected by local authorities to finance the construction maintenance of public infrastructure. Quit rent is an annual land tax imposed on private properties in malaysia while parcel rent is its equivalent for stratified properties both are payable to the state authority.

This is because the specified rate differs from one state to another so a 2500 square foot home in penang can be cheaper or more expensive than an identical unit in kedah. Nowadays the national land code makes it compulsory for all landowners to pay cukai tanah now also known as quit rent once a year to the relevant land office of their state government. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services.

This is determined by the estimated annual rental value of your property and multiplied by a rate. Redditus quieti freed the tenant of a holding from the obligation to perform such other services as were obligatory under feudal. Alienated land constitutes any leased land owned by the government or any land formerly owned by the government.

Annual rental value of a property varies according to factors such as market rate location and condition of the property. Since malaysia still has all its kings and the land tax is a healthy source of income for the states we citizens still have to pay it. This is similar to property tax in other countries.

Under feudal law the payment of quit rent latin quietus redditus pl. The quit rent for properties that are of the exact same size may not necessarily be the same across malaysia though. How does the tax work.

It will replace quit rent cukai tanah and unit owners will have to pay directly to the federal territories land and mines office pptgwp. Quit rent cukai tanah besides the assessment tax the other main cost associated with property and land ownership in malaysia is quit rent or cukai tanah. Parcel rent is not a new tax.